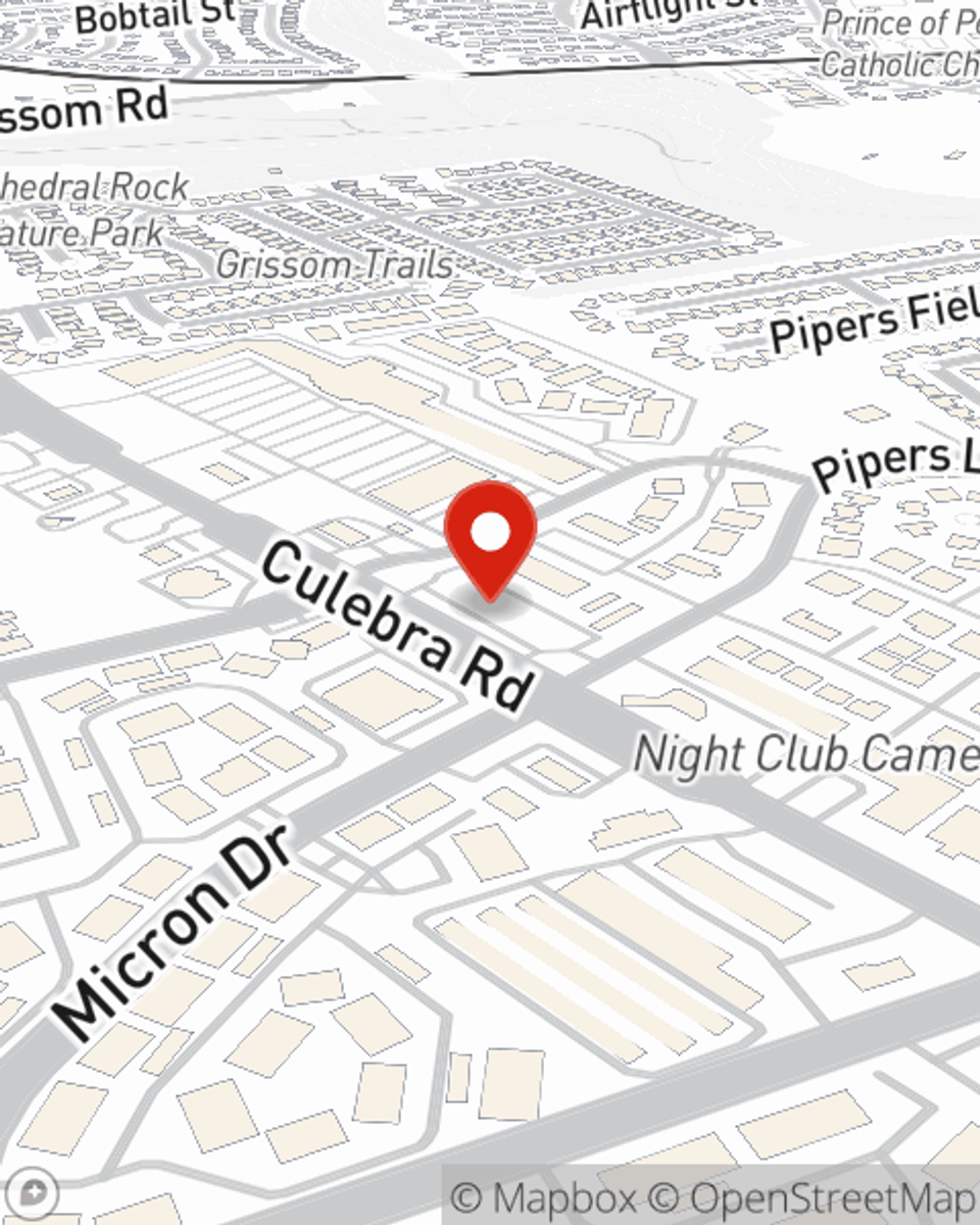

Business Insurance in and around San Antonio

San Antonio! Look no further for small business insurance.

This small business insurance is not risky

This Coverage Is Worth It.

You've put a lot of time into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a pet groomer, a flower shop, an antique store, or other.

San Antonio! Look no further for small business insurance.

This small business insurance is not risky

Keep Your Business Secure

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Michelle Soto Blackman. With an agent like Michelle Soto Blackman, your coverage can include great options, such as artisan and service contractors, business owners policies and commercial liability umbrella policies.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Michelle Soto Blackman is here to help you learn about your options. Get in touch today!

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Michelle Soto Blackman

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.